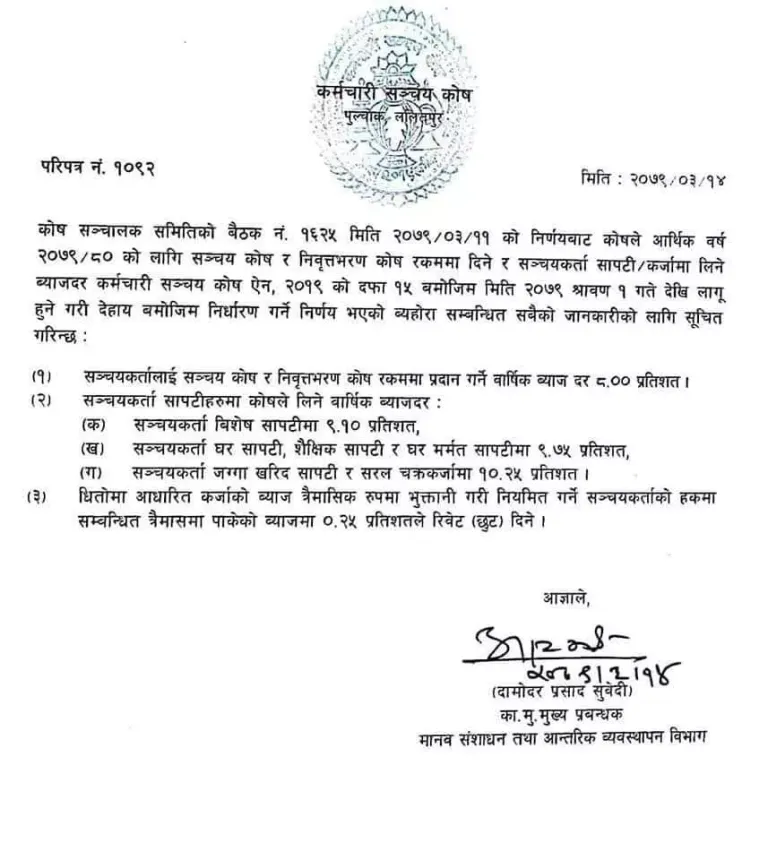

Karmachari Sanchaya Kosh EPF published the new interest rate for all service. EPF Nepal Interest Rate details. Employment Provident Fund New Interest Rate. Employee Provident Fund KSK Karmachari Sanchaya Kosh has increased the interest rate with effect from Shrawan 1, 2079. Accumulators and pension funds have been paying interest at the rate of 7 percent per annum, which has increased to 8 percent.

In addition, 9.10 percent interest will be charged on special loans. Similarly, the interest rate has been fixed at 9.75 percent on house loans, educational loans and home repair loans.

10.25 percent interest rate has been fixed for land purchase contracts and simple loans. Accumulation Fund has also announced that in the case of mortgage-based loans, a discount of 0.25 percent will be given to the depositors who pay the loan regularly on a quarterly basis.

EPF Interest Rate Nepal Karmachari Sanchaya Kosh Interest Rate Byajdar Nepal

Karcmachari Sanchaya Kosh Interest Rates- valid from 2079 Shrawan 1

- Provident Fund – 8%

- Pension Fund – 8%

- Special Loan – 9.10%

- Contributor Home Loan- 9.75%

- Contributor Education Loan- 9.75%

- Contributor Home Maintenance Loan- 9.75%

- Contributor Land Purchase Loan- 10.25%

- Revolving Loan- 10.25%

Special Loan by Karmachari Sanchaya Kosh EPF Bisesh Sapati

This facility is provided against member’s deposit in PF account. This facility is renewable every year.

Where to apply: Thamel Office or any other EPF branches convenient to contributor.

Eligibility: Members with two year regular PF contribution.

Maximum Limit: 80% of the accumulated PF amount.

Documents Required:

The recommendation from contributors’ institution in the form provided by EPF.

Copy of EPF identity card.

How to repay:

Through deposit into bank accounts specified by EPF.

Through connect IPS.

Online Special Loan

EPF has started its digital journey by beginning processing of Special Loan facility applications online considering the safety and service requirement of its Contributors. For details of the process involved please refer the following Process Manual.

Online Special Loan Repayment

EPF has also provisioned for online repayment of special loan taken from it through NCHL’s connectips.com with beneficial effect of immediate ledger processing that will update Contributor’s statement with repaid amount and need no submission of deposit vouchers at EPF offices plus other benefits. For more details please refer the following process manual.

House Loan by Karmachari Sanchaya Kosh Ghar Loan by EPF

Purpose:

To arrange accommodation.

To build a new house.

To add floors to the house.

To buy a house.

Eligibility:

One year of regular fund deduction and 2 years of service remaining on the basis of age or tenure.

Only after the completion of the work of DPC.

Limit:

A maximum of Rs. 1 crores not exceeding collateral valuation.

Amount equivalent to 12 years salary for contributors with less than 10 years service period remaining.

Amount equivalent to 15 years salary for contributors with more than 10 years service period remaining.

Repayment Period : Maximum 20 years with a grace period.

Borrowing flow:

Minimum 2 installments and maximum 4 installments based on work progress in case of house construction, first installment up to 50 percent.

The same collateral can be borrowed from the salary of both husband and wife as long as it can be beared.

Lump sum disbursement in case of house purchase.

Education Loan by Karmachari Sanchaya Kosh EPF Education Shiksha Loan

Purpose:

For the higher education of the contributor or his / her spouse or son / daughter for a maximum of 2 persons.

Qualification:

For one year regular fund deduction and 2 years service period remaining on the basis of age or tenure, at least for graduate studies.

Limit: collateral valuation or actual expenditure amount whichever is less.

25 lakhs for MBBS and M.D.

10 lakhs for study inside the country and 20 lakhs for abroad studies in case of other other subjects.

Duration:

Maximum 15 years with grace period.

Borrowing flow:

Lump sum and maximum of 4 installments.

Required documents:

Identity card of the fund

Proof of land ownership

Ownership deed

Chaar Killa – (original letter)

Cadastral extract – (original)

Citizenship of land owner and debtor

Tax payment receipt

Proof of relationship

Retirement date and salary letter from the concerned office

Student certificates

Citizenship of the student

Details of study expenses

A copy of the certificate of affiliation

Revolving Loan by Karmachari Sanchaya Kosh EPF Saral Chakra karja

Purpose: For social and other activities.

Qualification: One year regular fund deduction and 2 years of service periods remaining on the basis of age or tenure.

Limit: 10 years salary or Rs. 30 lakhs not exceeding collateral valuation, the lower limit being Rs. 5 lakhs.

Duration: Maximum 5 years loan flow: Minimum 1 lakh at a time .

Collateral Details

- Should be within Kathmandu Valley.

- Should be accessible with at least 13 feet road.

Required documents

- Identity card of the fund

- Proof of land ownership

- Ownership deed

- Chaar Killa – (original letter)

- Cadastral extract – (original)

- House building license

- Citizenship of landowner and debtor

- Proof of tax paid

- Proof of relationship

- Home Buyer & Seller Agreement – Home Buying Only)

- Retirement date and salary letter from the concerned office

New Government Salary Scale Sarkari Jagir Talab Scale Details

Canada Visa Apply- How To Get Canada Visa

H1B Visa America Working Visa Apply Now

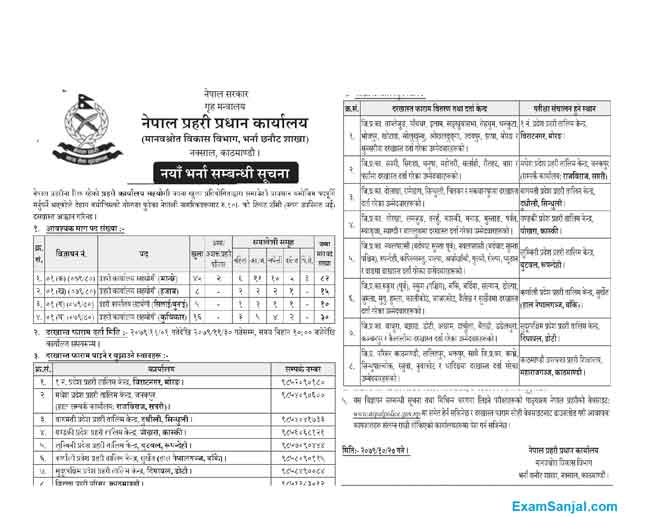

Nepal Police Job Vacancy

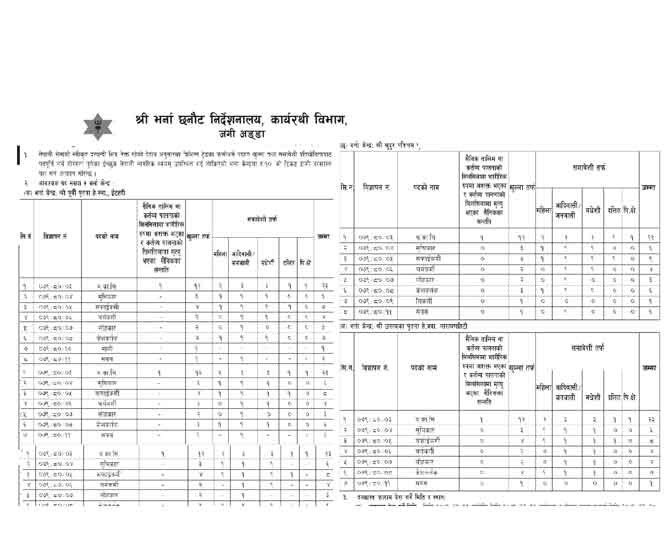

Nepal Army Nepali Sena Job Vacancy

Israel Working Visa Notice for 1000 Nepalese workers

Online Driving License Application ApplyDL.Dotm.Gov.np Apply Now