Mismatch Discount Facility for Day 1 & Day 2 Taxpayer. Government of Nepal Ministry of Finance, Internal Revenue Department, Important notice regarding exemption facility to taxpayers whose actual transaction number is different (mismatch). Mismatch Discount facility by Aantarik Rajashwo Bivag.

Taxpayers who have filed income statements and taxes in the previous income years (Day 01 and Day 02) and declared their turnover up to Fiscal Year 2077/78, if the actual turnover figures are different (mismatch), within 2079 Chaitra Last, declare the actual turnover of each financial year and the difference in sales amount. 1.5 percent tax declared by the taxpayer

This facility can be availed even in cases where the tax has been determined on the purchase and sale of the mismatched amount up to Fiscal Year 2077/78 and is in arrears and has gone to litigation. Section 29 of the Economic Act, 2079 provides for the finality of tax to the extent.

How To Check Mismatch How To Fill Entry Mismatch Details of Day 1 & Day 2 Taxpayer

For detailed information, you are advised to contact the Taxpayer Service Office or Internal Revenue Office where you are registered and use the discount facility.

Taxpayers who have submitted details of D01 / D02 by Fiscal Year 2077/078 and have a mismatch, using the facility provided by the Economic Act 2079, the deadline to re-declare the transaction is only up to 2079 Chaitra Last, so if your details are also mismatched, please do not use this facility before the deadline.

DO1/D02 For Taxpayers who have mismatched transactions, the process of viewing the details of mismatched transactions and declaring the actual transaction numbers:-

- Open the internet browser and open the Internal Revenue Department website Ird.gov.np.

- Go to the Taxpayer Portal on the website page.

- Go to Taxpayer Login under General Menu in Taxpayer Portal.

- Log in with username and password.

- After opening the Taxpayer’s Page, click on D01/D02 Mismatch Scheme.

- It shows the total amount of reported transactions for different financial years.

- The details of the reported transaction in each financial year (reporting firm, reported transaction amount, including the reported transaction amount) can be viewed on the D01/D02 Mismatch Scheme Details page that opens after clicking on the (–) eye symbol on the right. After viewing, close the Details page and click D01 /D02 Go to Mismatch Scheme page.

- If you click on the pencil symbol on the right side of the mismatched fiscal year and scroll down with the mouse, the revenue declaration form will appear.

- In the transaction declaration form, mention the actual transaction number in the column “declared transaction”.

- The amount of tax to be filed is displayed. Which is 1.5% of the difference amount. Note the amount and financial year. Filing tax due to mismatch Determine and note the tax amount according to the above procedure for every financial year.

- Prepare separate vouchers for each financial year mentioning the revenue title 11111 clearly revealing the financial year and tax amount and filing the tax amount.

Also view:

1. View All Job Vacancy Notice Details

2. View All TU Exam Result Center Update

3. View All Lok Sewa Exam Vacancy Tayari

New Government Salary Scale Sarkari Jagir Talab Scale Details

Canada Visa Apply- How To Get Canada Visa

H1B Visa America Working Visa Apply Now

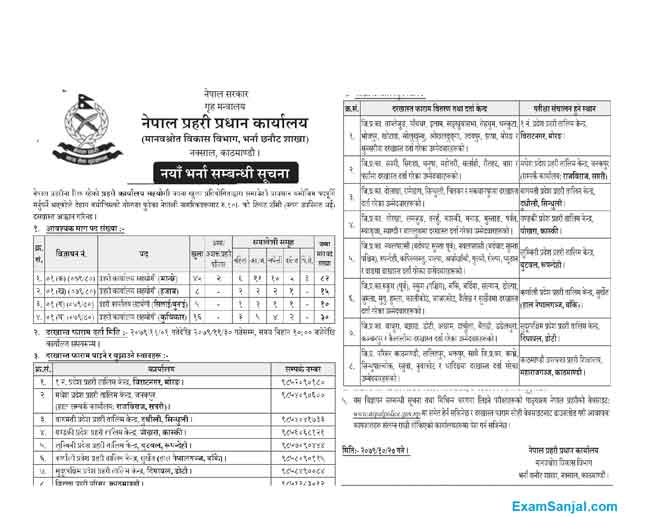

Nepal Police Job Vacancy

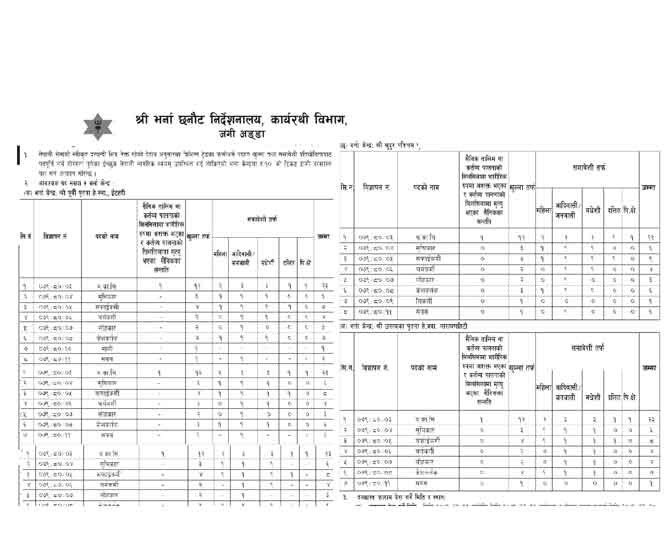

Nepal Army Nepali Sena Job Vacancy

Israel Working Visa Notice for 1000 Nepalese workers

Online Driving License Application ApplyDL.Dotm.Gov.np Apply Now