Karmachari Sanchaya Kosh Syllabus details all. Karmachari Sanchaya Kosh Syllabus Level 4 syllabus, Level 5 syllabus, Level 6 syllabus, Level 7 Syllabus & Level 8 Syllabus details. Employment Provident Fund EPF Syllabus pathyakram All. Karmachari Sanchaya Kosh (KSK), Employees Provident Fund (EPF) in English, established under Employees Provident Fund Act, 2019. We manage Provident Fund (PF) in Nepal on behalf of the Government of Nepal (GoN) for government, public enterprises and private sector employees.

Karmachari Sanchaya Kosh have been entrusted to manage Contributory Pension Scheme for the employees of Federal GoN and other public sector employees to be appointed from Fiscal Year 2076/77 as per the Pension Fund Act, 2075. Our relationship with GoN is routed through Ministry of Finance.

Karmachari Sanchaya kosh Syllabus Level 4 Level 5 Level 6 Level 7 Level 8 EPF Syllabus

Karmachari Sanchaya Kosh Syllabus Pathyakram Employment Provident Fund Syllabus Level 4 Assistant, Level 5 head Assistant Level, Level 6, Level 7 & Level 8 Syllabus, Various administrative, account & technical posts job vacancy syllabus of Karmachari Sanchaya Kosh.

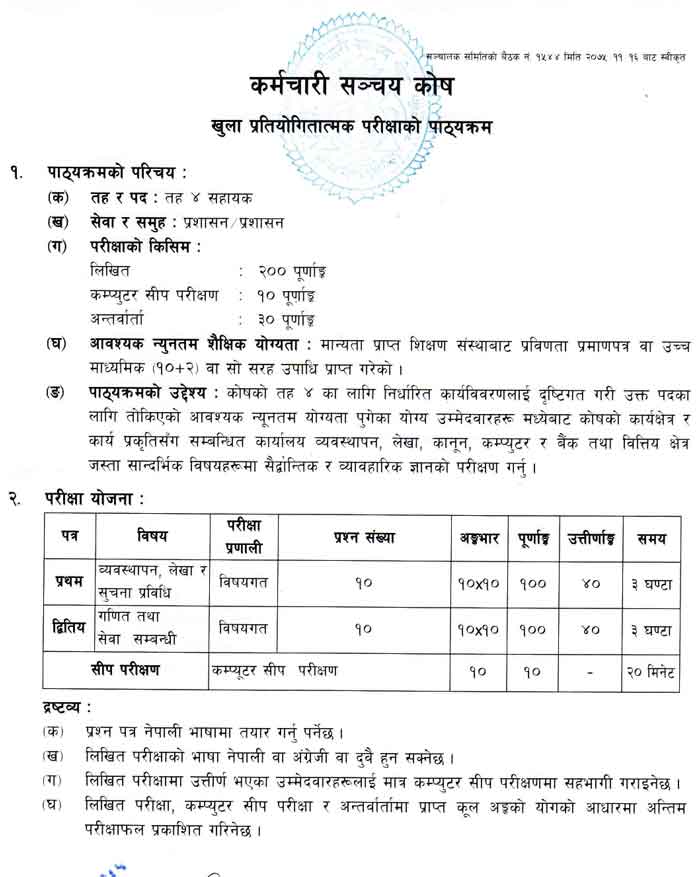

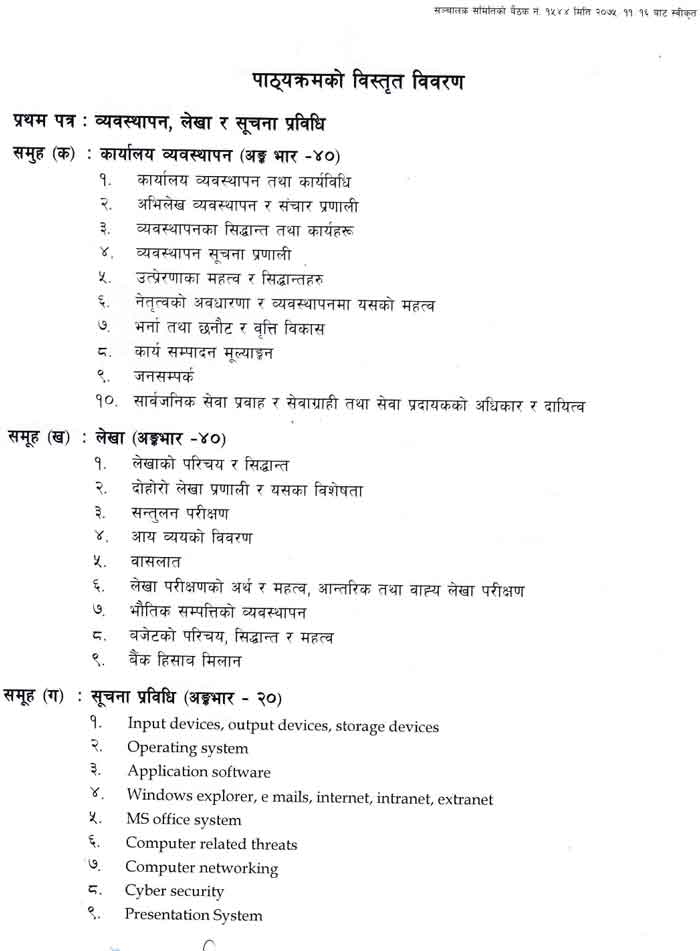

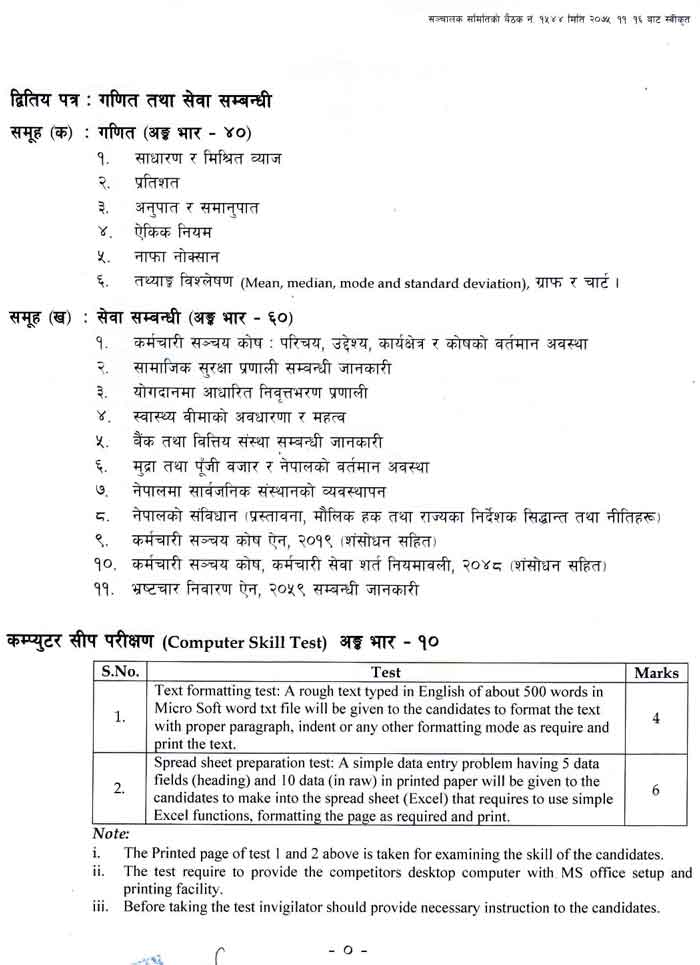

Karmachari Sanchaya Kosh Level 4 Syllabus Sahayak 4th Level EPF Syllabus

Karmachari Sanchaya Kosh Level 5 Syllabus Head 5th Level EPF Syllabus

Karmachari Sanchaya Kosh Level 5 Head Assistant Pramukh Sahayak update syllabus : Prasasan Administration 5th Level EPF Employment Provident Fund vacancy syllabus are given below.

Karmachari Sanchaya Kosh Manager Asst. Level 6 Syllabus Asst. Manager EPF Syllabus

Karmachari Sanchaya Kosh Assistant Manager level 6th update syllabus : Prasasan Administration 6th Level Manager EPF Employment Provident Fund vacancy syllabus is given below.

Karmachari Sanchaya Kosh Syllabus Level 4 to Level 8 View All Sanchaya Kosh Syllabus Below

Click View PDF Button to View or download all posts syllabus of Karmachari Sanchaya Kosh EPF Employment Provident Fund Syllabus.

- Syllabus -Level 8, Manager View PDF

- Syllabus -Level 5, Sub Engineer View PDF

- Syllabus -Level 6, Assistant Manager (Law) View PDF

- Syllabus -Level 7, Deputy Manager (Computer Engineer) View PDF

- Syllabus – Senior Manager(Administration) View PDF

- Syllabus – Manager(Administration) View PDF

- Syllabus – Manager(System) View PDF

- Syllabus – Deputy Manager (CA) View PDF

- Syllabus – Deputy Manager (Financial Analyst) View PDF

- Syllabus – Deputy Manager (Administration) View PDF

- Syllabus – Assistant Manager (Administration) View PDF

- Syllabus – Assistant Manager (Computer) View PDF

- Syllabus – 6th Level Assistant Manager (Administration) View PDF

- Syllabus – 6th Level Assistant Manager (Computer) View PDF

- Syllabus – 5th Level Head Assistant View PDF

- Syllabus – 4th Level Assistant View PDF

Vacancy.EPF.Org.np Apply Karmachari Sanchaya kosh jobs How to Fill Online Application

Online Form Filling Process:

1. Application form can be filled online only. The applicant will first have to fill in his details and register on the fund’s website: www.epfnepal.com.np.

2. While registering, the registration number will be received in the e-mail of the applicant and by logging in using the registration number as User ID and Password, fill in all the details to be filled in the online form prescribed by the Fund.

3. If there is a transcript of the minimum educational qualification prescribed for citizenship and application for the post, certificate of character and educational qualification obtained from a country other than Nepal, then the equivalent certificate from Tribhuvan University and passport size photo should be scanned / attached and uploaded. It is advised to fill the online application form within 21 (twenty one) days from the date of first publication in Gorkhapatra and within 7 (seven) days after paying double fee.

4. Candidates are advised to fill up the online application form only after thoroughly studying the instructions given.

5. Once all the details are verified from the fund after the application is included, the application will be approved and then the candidate will have to print the admission card himself.

6. While appearing in the examination, the candidate must bring the original certificate of his / her citizenship along with the admission card printed by the candidate for identification, otherwise he / she will

Karmachari Sanchaya Kosh Employment Provident Fund Introduction Who we are ?

We are Karmachari Sanchaya Kosh (KSK), Employees Provident Fund (EPF) in English, established under Employees Provident Fund Act, 2019. We manage Provident Fund (PF) in Nepal on behalf of the Government of Nepal (GoN) for government, public enterprises and private sector employees. We have been entrusted to manage Contributory Pension Scheme for the employees of Federal GoN and other public sector employees to be appointed from Fiscal Year 2076/77 as per the Pension Fund Act, 2075. Our relationship with GoN is routed through Ministry of Finance.

According to Income Tax Act, 2058, EPF is an approved retirement fund that allows annual income deduction benefit on contribution by member to his/her PF and Pension Fund account and special tax benefit privilege at the time of repayment of PF after retirement.

We also provide some social security benefits to our contributors, viz medical treatment expenses reimbursement, maternity and child care benefit, funeral grant etc.

Our History Karmachari Sanchaya Kosh

History of Provident Fund (PF), in Nepal, dates back to 1934 AD when the PF scheme came into existence for army personnel formally as named Sainik Drabya Kosh (Army Provident Fund). The scheme operation was intended to remove immediate financial destitution to the army personnel on their retirement. Under the scheme, the army staff members were required to contribute certain percentage of monthly salary to their PF account repayable after retirement. A decade later in 1944, similar scheme was also initiated for civil service employees working at Kathmandu valley (the capital city of the country) named as Nijamati (Civil) Provident Fund. In the year 1948 the coverage of the scheme was extended to all the civil servants working throughout the country. In 1959, Employees Provident Fund Department was formed under the Ministry of Finance and Economic Affairs of GoN to manage both Sainik Drabya Kosh and Nijamati Provident Fund and the coverage was also extended to police service.

New Government Salary Scale Sarkari Jagir Talab Scale Details

Canada Visa Apply- How To Get Canada Visa

H1B Visa America Working Visa Apply Now

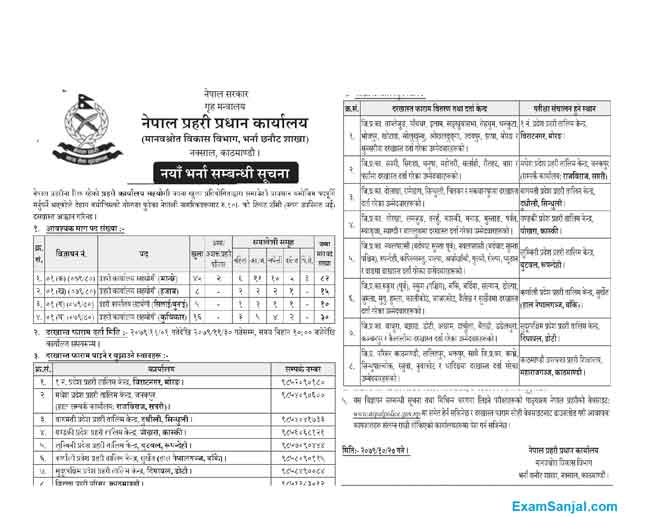

Nepal Police Job Vacancy

Nepal Army Nepali Sena Job Vacancy

Israel Working Visa Notice for 1000 Nepalese workers

Online Driving License Application ApplyDL.Dotm.Gov.np Apply Now

Three years after the establishment of Employees Provident Fund Department, “Employees Provident Fund Act, 1962” was enacted and accordingly EPF, as an autonomous body to manage provident fund, was formally incorporated on 16th September 1962 (BS 2019 Bhadra 31).

Contributing Members

Government employees and employees from state owned institutions attain automatic membership to EPF. These include personnel from the civil servants, army, police, state owned corporations, and government school /colleges/universities.

There are around 25,000 offices, as employer organizations, with about 628,000 employees as members regularly contributing to PF. Under recently introduced contributory pension scheme about 500 government offices have joined with us to maintain contributory pension fund of their newly appointed employees of around 14,400.

Contribution Rates

The rate of PF contribution for all employees is 10% of monthly salary and equal amount by the employer’s side. Hence, 20% of basic salary is credited in member’s PF account as monthly contribution. The prevailing contribution rate was initiated from the year 1971/72. Initially the rate was Rs. 2 to 475 based on their salary for member’s contribution and additional amount of 10% of member’s contribution from government’s side. In the year 1967/68 the rate was increased to 10% of their salary for member’s contribution and the addition contribution from government’s side was also revised as 50% for below officer level employee member and 25 % for officer level employee member.

The rate of Pension Fund contribution for employee is 6% of monthly salary and equal amount by the employer’s side.