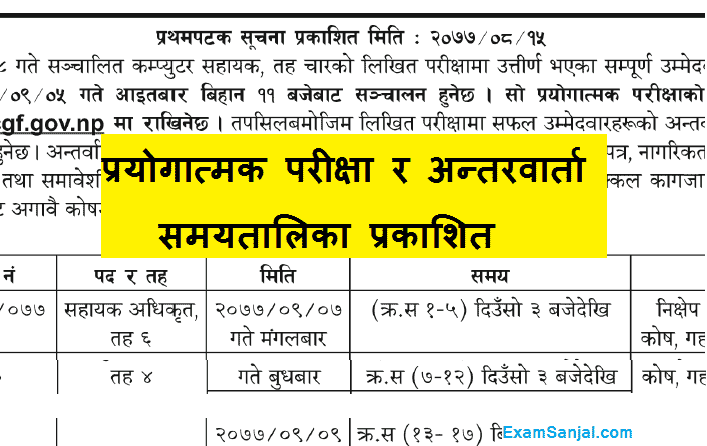

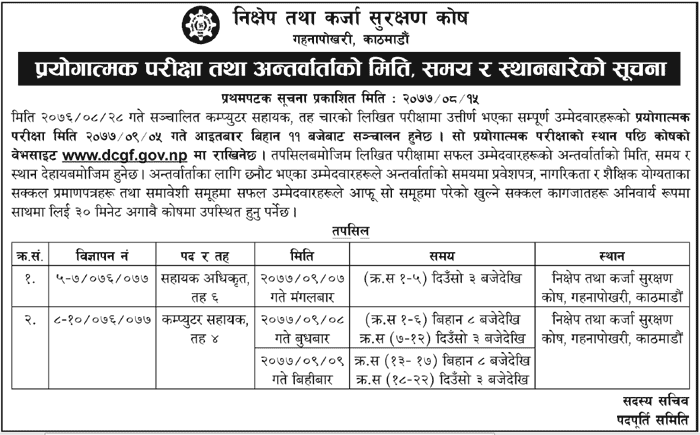

Deposit and Credit Guarantee Fund ( Nikshep Karja Surakshan Kosh) published notice regarding practical examination routine and interview date. Information about the date, time and place of the Practical exam and interview.

Information that all the candidates who have passed the written test of computer assistant, level four will be conducted on different dates.

The date, time and place of interview of the successful candidates in the written examination will be as per the details.

Candidates selected for the interview must be present at the fund 30 minutes in advance at the time of the interview along with the original certificate of admission, citizenship and educational qualifications and the successful candidates in the inclusive group.

View All New Job Vacancy List

About Deposit & Credit Guarantee Fund( Nikshep tatha Karja Surakshan Kosh)

Financial stability is one of the topical issues that has been accorded increased attention from central bank, government, market players, borrowers and deposit insurer. As a deposit insurer, Deposit and Credit Guarantee Fund(DCGF) has started the deposit guarantee scheme in Nepal from the year 2010. Deposit guarantee/insurance is recognized globally as an important component of a country’s financial safety net and has been implemented in more than 120 countries around the world. It is a system that protects depositors against the loss of their guaranteed deposits placed with banks and financial institutions (BFIs) in the case of unlikely event of the BFIs failure. DCGF has given the statutory responsibility to perform both the deposit guarantee and credit guarantee function through it’s own “Deposit and Credit Guarantee Fund Act, 2073”. In the DCGF Board there has been representation of six from the government and one from Nepal Rastra Bank. Obviously, DCGF is a government sponsored and administered separate entity. Generally, deposit guarantee system is a government sponsored scheme.

In Nepal, deposit guarantee scheme is confined to BFIs namely

Commercial banks

Development banks

Finance companies and

Micro credit development banks

DCGF has fixed the premium rate of 0.16 % on guaranteed deposit to all BFIs member institutions. The coverage of deposit guarantee is limited to Rs 3,00,000 per natural individual depositors per member institution applicable on a combination of saving and fixed deposit.