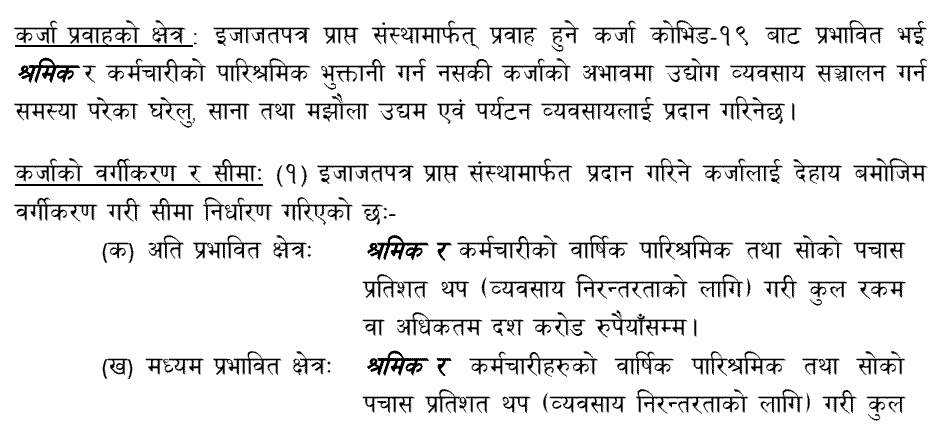

Nepal Rastra Bank recently published the Procedure (Karyabidhi) for the implementation of the Business Continuity Loan Credit Flow for various business organizations for Labour and Employment salary support purpose. Regarding Business Continuity Credit Flow Procedure, 2077 Nepal Rastra bank declare the following procedure (karyabidhi) for Loan.

Areas of loan disbursement: Loans disbursed through licensed institutions will be provided to domestic, small and medium enterprises and tourism businesses that are affected by COVID-19 and are unable to pay their wages due to lack of credit.

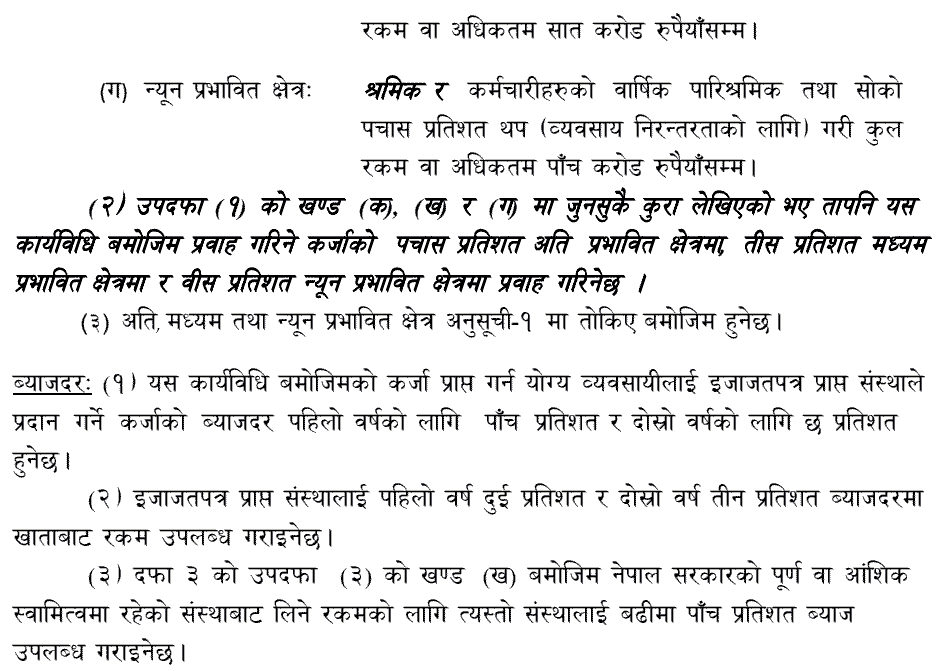

Debt classification and limits:

(1)Loans provided by a licensed institution are classified as follows:

(A)Highly Affected Areas: Annual Remuneration of Workers and Employees and Fifty

Adding percentage (for business continuity) to the total amount or up to a maximum of Rs. 100 million.

(B)Moderately affected area: Annual remuneration of workers and employees and so on

Fifty percent more (for business continuity)

(C)Minor affected areas: Annual wages of workers and employees and fifty percent additional (for business continuity) up to a total amount or a maximum of Rs. 50 million.

Interest rates for Business Continuity loan/ Employement Salary Loan:

(1)The interest rate of the loan provided by the licensed entity to the entrepreneur eligible to obtain loan as per this procedure shall be five percent for the first year and six percent for the second year.

(2)Money will be made available from the account to the licensed institution at an interest rate of two percent in the first year and three percent in the second year.

(3)A maximum of five percent interest shall be provided to such institution for the amount to be taken from the institution which is wholly or partially owned by the Government of Nepal.

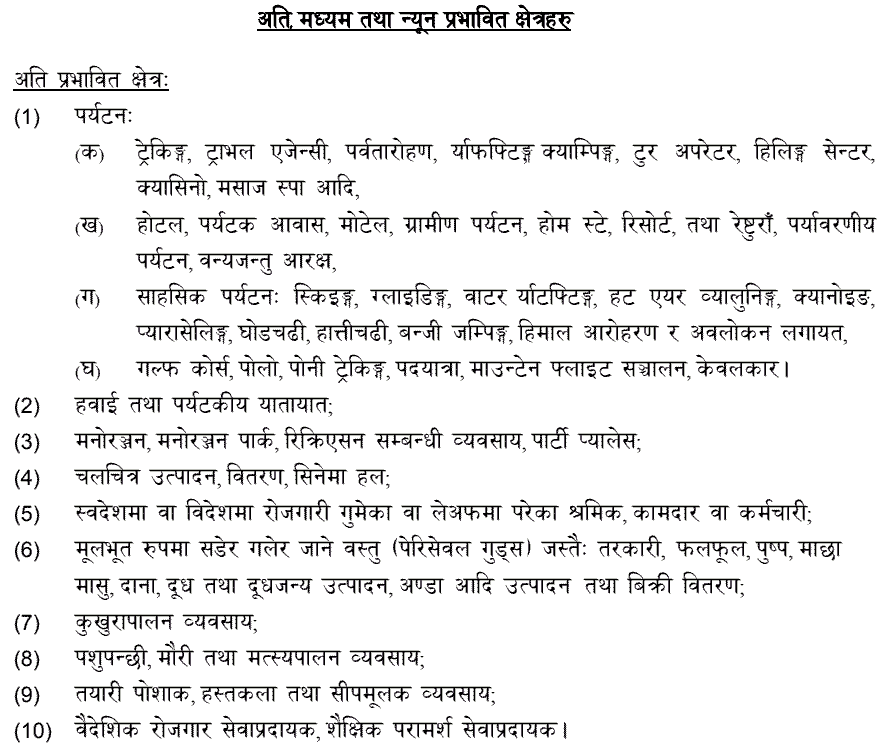

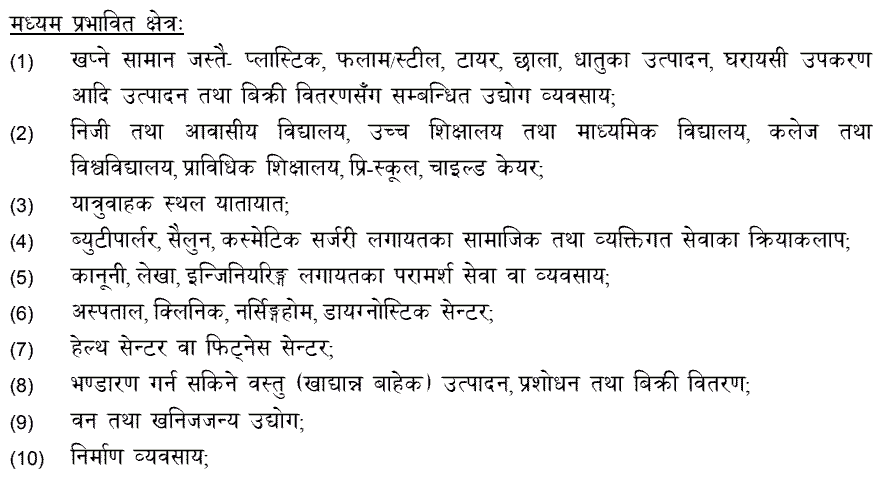

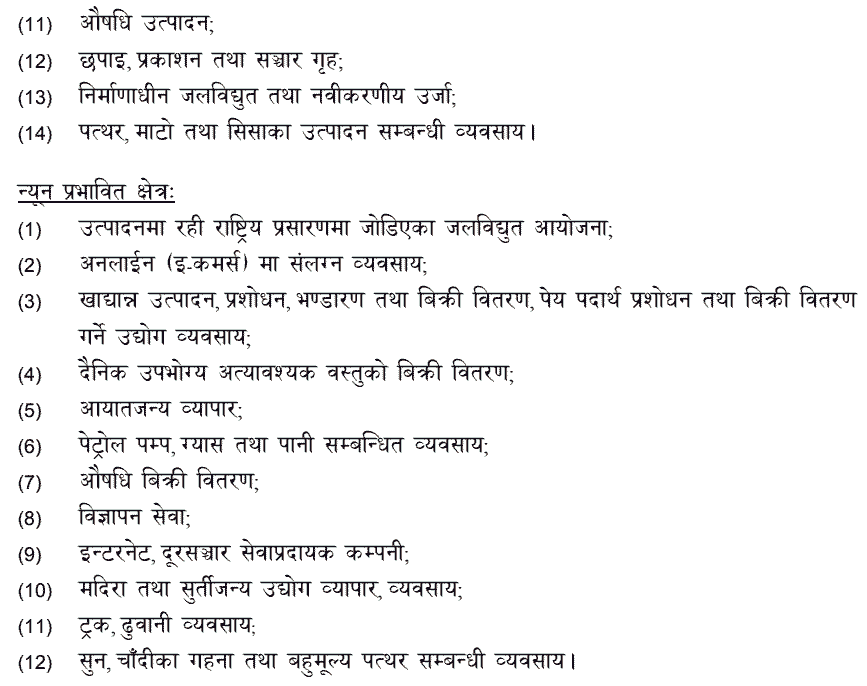

List of Highly Affected business Organization Area, Moderately Affected Areas and Minor Affected Areas are Below:

Loading Below………… Please Wait- Business Continuity Loan Credit Procedure or Click Here

Also View:

1. All new Job Opportunity List

2. Banking Exam Vacancy Update