What is a tax? What are the types of taxes? Explain. Income Tax Rate Nepal. Individual Married Couple Tax Rate Nepal. Digital Electronic Service Tax. TDS Rate Tax deduct at Source rate. Tax Rate in Nepal Update. Which bodies have to pay how much tax from Shrawan 1? (With list). The Inland Revenue Department has made public the tax rate applicable for the body in the coming Fiscal Year 2079/80. The department has made public the tax rate that will be applicable from Shrawan 1, 2079, as per the provisions made in the Finance Act and the budget made public by the Government of Nepal.

Accordingly, the general business body will be taxed at the rate of 25 percent. Such as Banks, Financial Institutions, General Insurance Business or Telecommunication and Internet Services, Money Transfer, Capital Market Business, Securities Business, Merchant Banking Business, Commodity Futures Market, Securities and Commodity Brokers Business, Cigarettes, Wendy, Cigar, Bodies dealing in food, khaini, gutkha, betel spice, liquor and beer or those operating petroleum in accordance with the Nepal Petroleum Act, 2040 will be taxed at the rate of 30 percent.

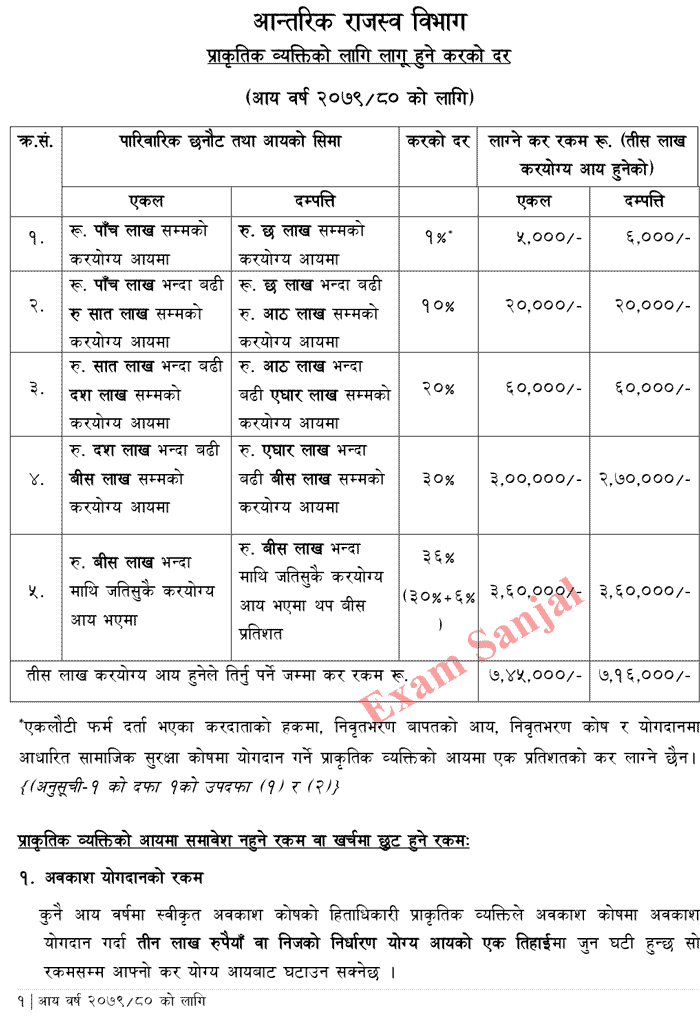

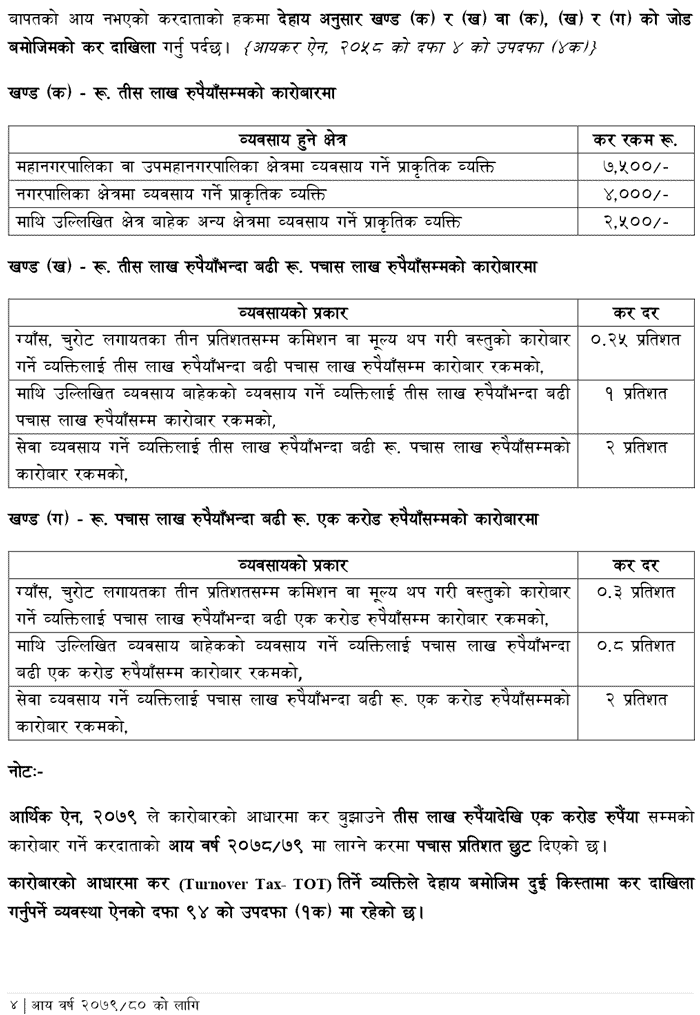

Income Tax Rate in Nepal for Individual

- Up to 5 Lakhs – 1% Tax Rate

- 5 Lakhs to 7 Lakhs – 10% Tax Rate

- 7 Lakhs to 10 Lakhs- 20% Tax Rate

- 10 Lakhs to 20 Lakhs- 30% Tax Rate

- 20 Lakhs & Above- 36% Tax Rate

Income Tax Rate in Nepal for Married Couple

- Up to 6 Lakhs – 1% Tax Rate

- 6 Lakhs to 8 Lakhs – 10% Tax Rate

- 8 Lakhs to 11 Lakhs- 20% Tax Rate

- 11 Lakhs to 20 Lakhs- 30% Tax Rate

- 20 Lakhs & Above- 36% Tax Rate

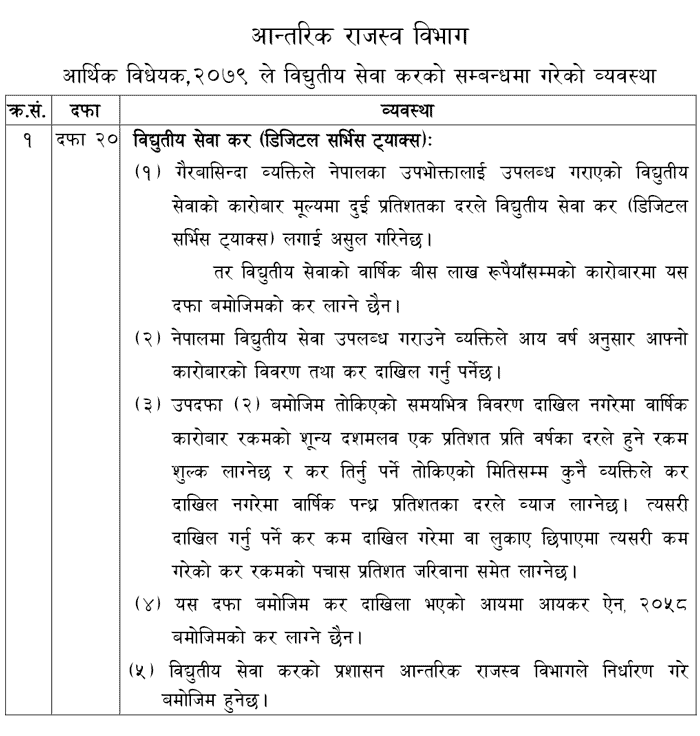

Digital Service Tax Electronic Service Charge Tax Rate Nepal E Service Tax Rate Nepal

Telecommunication Service Charges

The telecommunication service fee provided by the Economic Act is also coming into force from 2079 2080 fiscal Year. The service charge which was previously 13% has been fixed at 10% with the start of the new financial year.

Taxes on Outsourcing

1% Tax One percent tax will be paid on the taxable income for earning income from outsourcing while living in Nepal. This is also implemented for the first time in Nepal. After this arrangement, especially those who work in information technology living in Nepal will come under the scope of tax from now on.

Salaries of Government Employment Increased by 15%

Salaries of government employees are increasing by 15 percent with effect from July. Army, police, teachers, employees of government-owned institutes along with civil servants will benefit from this.

Electrical Service Tax Rate Nepal

Electricity service tax is being implemented for the first time from 2079 2080 Fiscal Year. For this, the Electricity Service Tax Procedure, 2079 has been prepared and is at the stage of implementation. According to this new arrangement, from now on platforms like YouTube, Facebook, Netflix have come under the scope of tax. These platforms will have to pay taxes in Nepal from now on.

The Economic Act provides that these platforms, which earn more than 2 million rupees annually, must pay two percent of the transaction value. Even if you do not have a permanent account number, everyone who earns income in Nepal by providing electrical services will have to pay tax.

TDS Tax Rate Nepal Tax Deducted at Source Agrim Kar Katti Rate Nepal

Paragraph 17 of the Income Tax Act, 2058 provides for tax deduction / advance tax deduction at source for the purpose of bringing taxable persons under the scope of income tax and for regular tax collection. When a person makes a payment in the form of payment mentioned in paragraph 17 of the Income Act of any person in the income year, in any case the tax is deducted at the prescribed rate and the remaining amount is paid.

The person who is responsible for deducting advance tax and collecting advance tax should deduct tax on the payment prescribed by the tax law and collect advance tax on profit and transaction. This is called tax deduction at source (TDS) as tax is deducted at the time of payment i.e. at the source itself.

What Is TDS Tax Deducted at Source Agrim Tax Kar Katti

When a person makes a payment in the form of payment mentioned in paragraph 17 of the Income Act of any person in the income year, in any case the tax is deducted at the prescribed rate and the remaining amount is paid.

The person who is responsible for deducting advance tax and collecting advance tax should deduct tax on the payment prescribed by the tax law and collect advance tax on profit and transaction. This is called tax deduction at source (TDS) as tax is deducted at the time of payment i.e. at the source itself.

It is also called Withholding Tax as it deducts the tax from the payee. Since the tax is paid at the time of income, the concept of paying tax in this way is also called Pay As You Earn (PAYE). Due to this system, the government will be able to collect revenue in advance and more taxpayers will be included in the tax range and also the compliance cost of both the government and the taxpayer will be reduced. Especially for the purpose of taxing the income of unorganized sector, scattered and small paid and inactive natural person (Hard to Tax Group).

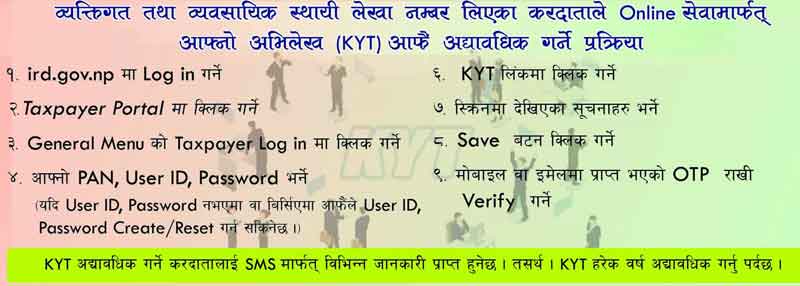

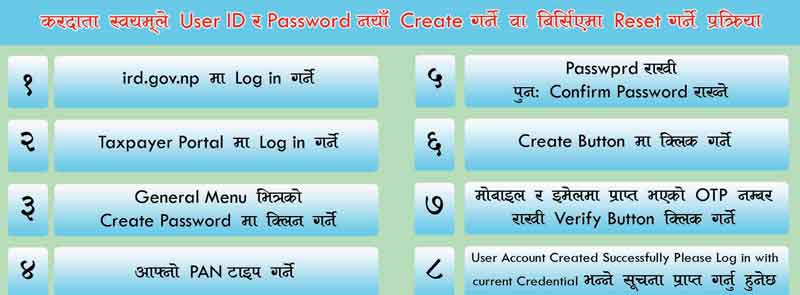

Pan Login Register KYT Update IRD.Gov.np PAN User ID Password

Similarly, the cooperatives registered under the Cooperatives Act, 2074 will be taxed at the rate of 7.5 percent if they operate within the municipal area, 10 percent if operated within the sub-metropolitan area and 15 percent if operated within the metropolitan area.

Online PAN Registration Process- HOW to Get Pan Number Pan Card Ird.gov.np Tax Portal

Similarly, 20 percent tax will be levied on the taxable income of the school and college registered under the public trust and 5 percent tax will be levied on the income of a non-resident person sent abroad by a foreign permanent establishment in Nepal in any income year.

In any income year, 5 percent tax will be levied on the taxable income of any non-resident person as per the income mentioned in section 70 of the Act but 2 percent tax will be levied on the non-resident person providing water transport, air transport or telecommunication service from Nepal to another foreign country.

Similarly, in the income year 2079/80, 1 percent tax will be levied on the resident person who earns foreign currency by doing business providing information technology based services including business process outsourcing, software programming, cloud computing.

‘Obligatory obligation to state’

- The tax paid by the citizen to the government without expecting any direct benefit is called tax.

- Tax is a mandatory payment to the government by an individual firm or company as per law.

- The monetary income that the government must collect from its citizens is called tax.

- The main source of income of the state is the mandatory payment that the citizen has to pay to the state.

- The government conducts regular, contingency and developmental activities of the country from the income received through this tax.

- Taxpayers should not expect direct benefits in return for taxes. However, the government has tried to provide some benefits to the taxpayers through taxes.

Types of taxes in Nepal

It is divided on the basis of tax area, collecting body, nature, scope and rate. Accordingly, the tax is divided into two parts.

1) Direct tax

- Weight, impact and impact on the same person tax is called direct tax.

- Taxes that are completely unpaid by those who are taxed.

- Taxes of a non-transferable nature are direct taxes.

- Income tax, property tax, real estate tax are examples of direct taxes.

2) Indirect tax

- Weight and Impact Taxes that fall on different people are called indirect taxes.

- The burden of paying taxes falls on one side and the effect of that tax falls on the other side.

- It is also understood as load transfer tax.

- Customs, excise, value added tax on goods and services are indirect taxes.

The development, progress and progress of the country is determined by the utilization of income tax which is not to be returned. As the basis of the relationship between the citizen and the government, it is necessary today to achieve economic development and growth through the wise use of taxes.

New Government Salary Scale Sarkari Jagir Talab Scale Details

Canada Visa Apply- How To Get Canada Visa

H1B Visa America Working Visa Apply Now

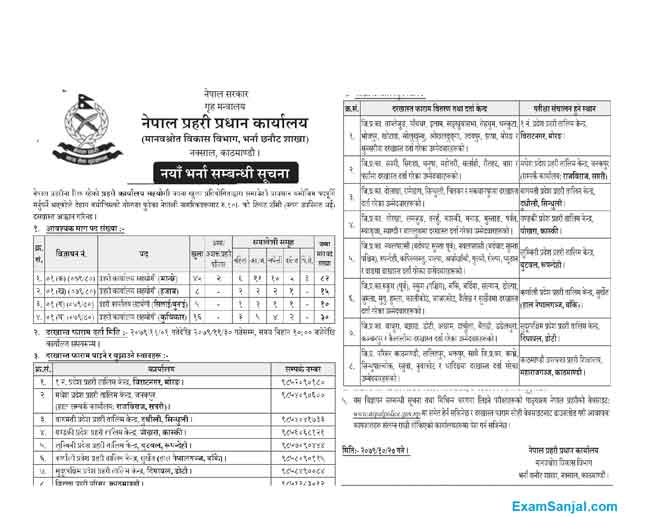

Nepal Police Job Vacancy

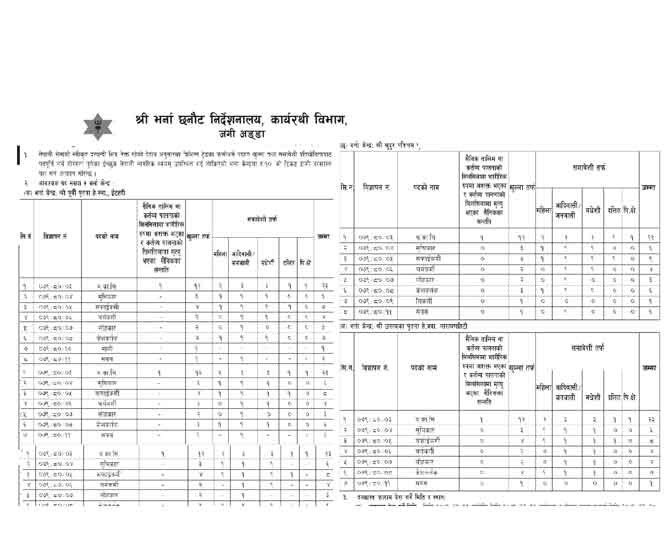

Nepal Army Nepali Sena Job Vacancy

Israel Working Visa Notice for 1000 Nepalese workers

Online Driving License Application ApplyDL.Dotm.Gov.np Apply Now